Hey Black Swan Nation !

Thank you for being part of the Black Swan adventure. If you like our content, share this newsletter with your friends and your network. Support you and get access to exclusive content by subscribing below.

This week, in less than 10 minutes, we'll cover these topics :

I. Investing in start-ups in Nigeria in 2023: a comprehensive guide with statistics

II. Exploring the best platforms to discover Nigerian startups for investment

III. Some African Unicorn

I.Investing in Start-ups in Nigeria in 2023: A Comprehensive Guide with Statistics

Start-ups are emerging businesses that offer unique solutions to various problems faced by society and individuals. In recent years, the number of start-ups in Nigeria has increased, leading to an increased interest in investment opportunities in these businesses. The Nigerian start-up ecosystem has shown significant growth, with several start-ups achieving international recognition, attracting investment from global investors, and creating new jobs for the Nigerian population. In this article, we will explore how to invest in start-ups in Nigeria in 2023, including key statistics on the start-up ecosystem in the country.

1.Understanding the Start-Up Ecosystem in Nigeria

Before investing in start-ups in Nigeria, it is essential to have a clear understanding of the start-up ecosystem in the country. The Nigerian start-up ecosystem has matured over the years, with the growth of incubators, accelerators, and venture capital firms. Currently, there are over 100 incubators and accelerators in Nigeria, providing support and resources to start-ups in the country. The Nigerian government has also provided support to the start-up ecosystem through policies aimed at fostering entrepreneurship and innovation. Additionally, the increased use of technology in Nigeria has also provided a platform for start-ups to grow and reach new customers.

2. Identifying the Right Start-Up to Invest In

Once you have an understanding of the start-up ecosystem in Nigeria, the next step is to identify the right start-up to invest in. There are several factors to consider when choosing a start-up to invest in, including the size of the market opportunity, the founding team, the level of competition, and the start-up's growth potential. It is important to research the start-up's market, understand its competitive landscape, and assess the founding team's experience and skills. Additionally, it is advisable to speak with the start-up's customers and other stakeholders to gain a deeper understanding of the business.

3. Due Diligence and Legal Considerations

Due diligence is a crucial step in the investment process, and it is important to take the time to thoroughly research the start-up and its financials. This process involves reviewing the start-up's financial statements, contracts, and other legal documents. It is advisable to work with a lawyer or financial advisor who has experience in investing in start-ups to ensure that you have a clear understanding of the legal and financial risks involved. Additionally, it is important to understand the tax implications of your investment and to have a clear understanding of the start-up's ownership structure.

3. Investment Options and Approaches

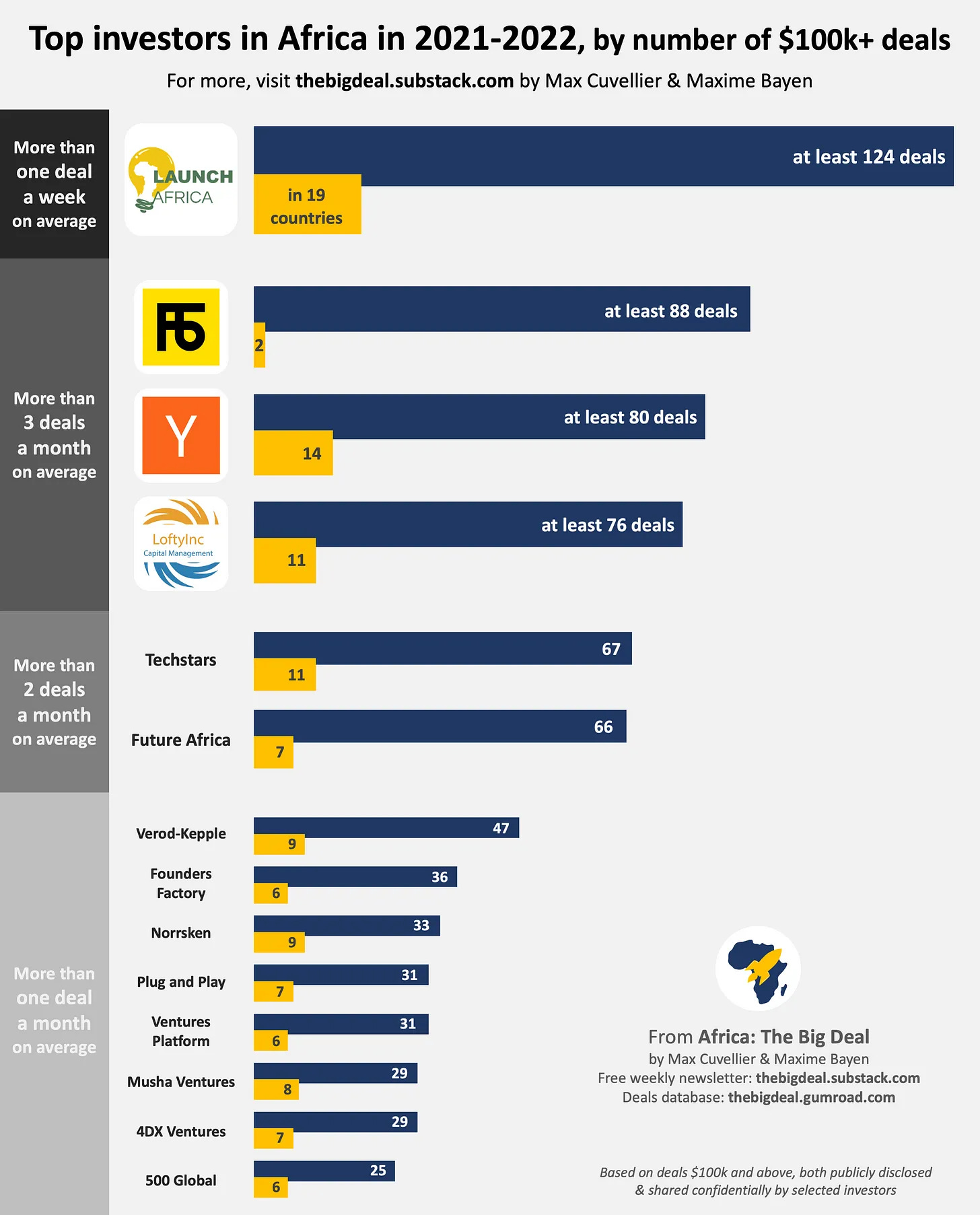

There are several investment options available to individuals who are interested in investing in start-ups in Nigeria. One option is to invest directly in a start-up by purchasing equity in the business. Another option is to invest in a venture capital firm that specializes in investing in start-ups. Currently, there are over 50 venture capital firms in Nigeria, with an average investment size of $500,000. Additionally, there are angel investment groups and crowdfunding platforms that provide investment opportunities in start-ups. When deciding on an investment approach, it is important to consider your investment goals, risk tolerance, and time horizon.

4. Key Statistics on the Nigerian Start-Up Ecosystem

As of 2023, there are over 20 start-ups in Nigeria valued at over $1 billion, known as "unicorns."

In 2022, start-ups in Nigeria raised over $500 million in funding, a 20% increase from the previous year.

The average size of a funding round in Nigeria is $2 million.

II. Exploring the Best Platforms to Discover Nigerian Startups for Investment

Investing in startups can be a lucrative opportunity for those looking to grow their wealth. With a thriving startup scene in Nigeria, finding credible prospects to invest in is essential. Here are several places to consider when searching for the best Nigerian startups to invest in:

LinkedIn NG

LinkedIn is a professional networking platform used by individuals and businesses globally to connect, find opportunities, and grow their careers and companies. The LinkedIn Nigeria community is bustling with startups and businesses seeking the right connections and looking to spread the word about their offerings. By reaching out to a company, studying its operations, and discussing with its founders, you can determine whether the startup is worth your investment.

Crunchbase

Crunchbase is a go-to source for gaining insights into companies, from early-stage startups to large corporations listed on the Fortune 1000. The Crunchbase hub for Nigerian startups provides a comprehensive list of all startups operating in the country, complete with details about the companies, their founders, and their employees.

Nigerian Investment Promotion Company (NIPC)

The NIPC is the government agency responsible for promoting investments in Nigerian startups and companies. It's a great place to start your search for investable startups as the NIPC provides investment guides and regulations, and even has a One-Stop Investment Center (OSIC) that streamlines services for investors.

Lagos Startup Week

Lagos is Nigeria's commercial hub and is home to many startups. One event to attend when searching for Nigerian startups to invest in is the Lagos Startup Week. This week-long tech startup event features keynote speeches, innovative tours, and an exhibition and startup showcase. Here, you can connect with startups in need of funding, and assess if they are a good fit for your investment portfolio.

TechCabal’s Startup Hub

TechCabal is a website that provides updates and events from the African tech ecosystem. It covers startups, fundraising, expansions, regulations, and other topics relevant to the tech industry. The Startup category is where you can find information about startups, including acquisitions, expansions, fundraising efforts, closures, and more. This is a valuable resource when searching for the right startup to invest in.

Startup Grind Lagos

Startup Grind is a global community powered by Google that provides a platform for entrepreneurs to connect and pitch to investors. With a presence in Lagos, Startup Grind holds monthly meetings for entrepreneurs to attend and connect with potential investors. As an investor, you can attend these events, connect with entrepreneurs, and sort through the startups to find the right fit for your investment portfolio.

It's important to note that most Nigerian startups find investors through direct pitching and events, as crowdfunding services like Kickstarter, Indiegogo, Y Combinator, and others are not widely available in the Nigerian investment sector. By exploring these resources and attending startup events, you can find the best Nigerian startups to invest in and grow your wealth.

III. African Unicorn

Brief presentations of each startup:

Chipper Cash

Chipper Cash is a fintech startup that provides cross-border P2P mobile payments. Valuation: $1.3 billion. Sector: Fintech. Last funding round: Series C, $170 million. Website: chippercash.com

Wave

Wave is a Canadian fintech company that provides small business software solutions. Valuation: $1 billion. Sector: Fintech. Last funding round: Series C, $71 million. Website: waveapps.com

Andela

Andela is a talent accelerator that trains and hires top African technology talent. Valuation: $100 million. Sector: Human Capital. Last funding round: Series D, $100 million. Website: andela.com

Flutter Wave

Flutter Wave is a fintech company that provides payment and banking technology solutions for businesses. Valuation: $1 billion. Sector: Fintech. Last funding round: Series C, $170 million. Website: lutterwave.com

Jumia

Jumia is an e-commerce platform that operates in Africa and the Middle East. Valuation: $1.5 billion. Sector: E-commerce. Last funding round: Private equity, $190 million. Website: jumia.com

Esusu

Esusu is a fintech startup that provides alternative financial services to underserved communities. Valuation: Undisclosed. Sector: Fintech. Last funding round: Seed, $2 million. Website: www.esusu.com

Interswitch

Interswitch is a digital payments company that operates in Africa. Valuation: $1 billion. Sector: Fintech. Last funding round: Undisclosed.

Website : interswitchgroup.com

Fawry

Fawry is an Egyptian fintech company that provides electronic payment services. Valuation: Undisclosed. Sector: Fintech. Last funding round: Undisclosed. Website: fawry.com

NFTfi

NFTfi is a decentralized finance platform that uses Non-Fungible Tokens (NFTs) to provide financial services. Valuation: Undisclosed. Sector: DeFi. Last funding round: Undisclosed. Website: nftfi.com