Hey Black Swan Nation !

Thank you for being part of the Black Swan adventure. If you like our content, share this newsletter with your friends and your network. Support you and get access to exclusive content by subscribing below.

This week, in less than 5 minutes, we'll cover these topics :

I. Billion investment

II. Who are the investors ?

III.The characteristics of key deal types in Africa in 2021

Let’s get started !

I. Billion investment

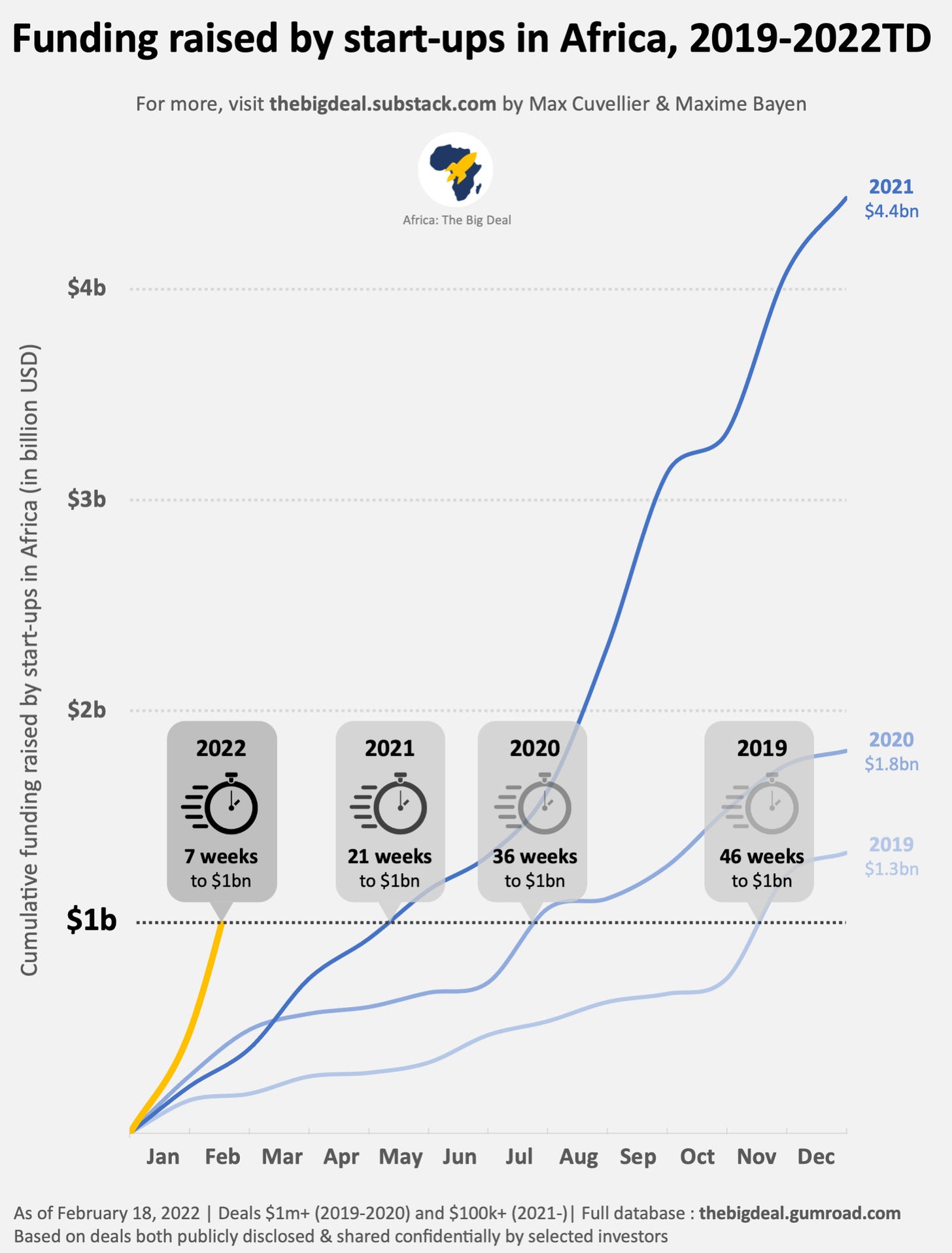

Africa's start-ups are raising money quicker than ever before, with some surpassing the $1 billion barrier in less than five months'. Indeed, it took African start-ups only 7 weeks to raise their first billion in 2022, thanks to more than 130 transactions. In comparison, it took the ecosystem 10.5 months in 2019, 8 months in 2020, and 5 months in 2021 to get there. Two'mega deals' ($100 million+) have already been reported in the first seven weeks of 2022: Tunisia's InstaDeep's $100 million Series B in late January, and Flutterwave's $250 million Series D revealed last week. However, they only account for around a third of the total funds raised. So far, start-ups based in one of the 'Big Four' (NG, ZA, KE, EG) have scooped the majority of the investment (76 percent) and agreements (78 percent), though Tunisia (almost completely driven by the InstaDeep transaction) and Ghana (6 deals for $56 million) are also doing well. Fintech accounts for about half of all financing obtained to date (47 percent), roughly in line with projections for 2021.

🔮 Now for the take-it-with-a-grain-of-salt moment from the crystal ball: What does this imply? We're looking at about $7.3 billion in 2022 assuming fundraising continues at the same rate throughout the year. It may appear excessive, but similar calculations in past years would have repeatedly underestimated the real result: by $0.2 billion (-15%) in 2019, $0.3 billion (-20%) in 2020, and $1.9 billion (-44%) in 2021. Just a thought...

II. 🖋️ Who are the investors ?

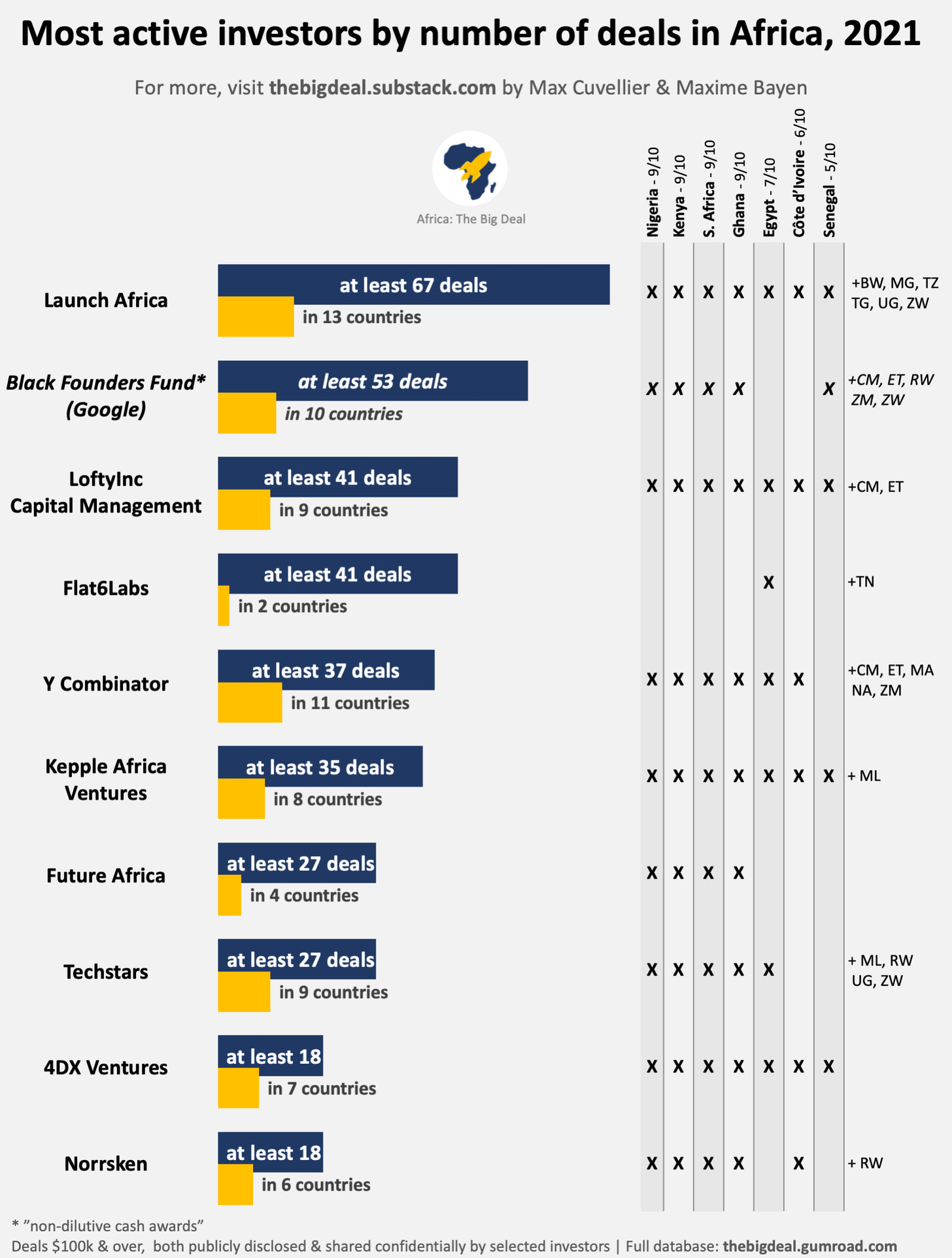

You need a very active investor community to sign hundreds of $100k+ agreements like what happened in Africa in 2021 - more than 800 in total. In fact, over 800 investors were involved in at least one acquisition on the continent last year, according to our research. However, the majority of them (70 percent) had merely dabbled and were only involved in one venture; this percentage rises to 81 percent when investors who had 'only' done one or two deals are included. This week, though, we're focusing on individuals who have gone all-in! Though it's possible that a trade or two may have slipped through the cracks due to the sheer volume of them, and some of them being undeclared, several significant hitters emerge. Launch Africa is the most active investor in Africa in 2021, both in terms of the quantity of deals (we monitored 67!) and the countries they invested in (13). Despite being ranked second, Google's Black Founders Fund (BFF) is unique in that the $5 million they allocated in 2021 were "non-diluted cash prizes." If we exclude Google's BFF, the top three investors are Launch Africa, LoftyInc Capital, and Flat6Labs, three venture capital firms based in Africa (Mauritius/South Africa, Nigeria, and Egypt, respectively). Future Africa is the Top 10's fourth Africa-based company. Y Combinator and Techstars (both global in scope) and 4DX Ventures (in addition to BFF) are headquartered in the United States (Africa-focused). The Top 10 is completed by Kepple Africa (Japan) and Norrsken (Norway). So, where are they putting their money now? In 2021, nearly all of them had made at least one agreement in Nigeria, Kenya, South Africa, and Ghana. Flat6Labs is the only company that has invested solely in Northern Africa. Egypt is second in terms of investor appeal (7 investors out of the Top 10) and is followed by Côte d'Ivoire (6/10) and Senegal (5/10), albeit the former had far more deals in absolute terms. They've put money into 21 different countries, expanding far beyond the 'Big Four.' Given that all of these entities are mostly investing at the pre-seed and seed stages, they're laying the groundwork for a slew of later-stage acquisitions that will hopefully make news in 2022 and beyond!

III. The characteristics of key deal types in Africa in 2021

Pre-Seed (Rabbit), Seed (Kuda), Series A (Naked), pre-Series B (TradeDepot), Series B (Solarise), pre-Series C (elmenus), and Series C (elmenus) agreements have been reported in Africa since 2019. (SPARK Schools). Although the reality varies greatly according on location, sector, and type of business model, there are some macro trends worth noticing if we look at data from 2021 (when the deal type was disclosed):

The further along in the process you are...

The larger the median deal size, the more likely it is to be successful. Although this appears to be self-evident, there are a number of exceptions. Pre-Series A is the outlier, with a typical deal size of less than Seed.

... the longer the company has been in existence. Okay, here's another one that should be self-explanatory. However, it's worth noting that the age of start-ups that raised money in the pre-Seed and Seed rounds is quite similar.

The greater the founding team, the more likely it is to succeed. In general, four people is a lot.

... the more'masculine' the founding team (from 71% of pre-Seed start-ups with a male founder or all-male financing team to 89 percent at Series B stage), and the CEO (from 71 percent of pre-Seed start-ups with a male founder or all-male funding team to 89 percent at Series B stage) (15 percent female CEOs at pre-Seed, down to 6 percent at Series B).

... the greater the likelihood of being in one of the 'Big Four' countries (up to 94 percent for Series B agreements) and fintech (albeit this is only true for Series B; the percentage of fintech deals is fairly steady between pre-Seed and Series A (1 out of 3)).

The End.

And if you think someone you know might be interested in this edition of Black Swan, feel free to simply forward this email or click the button below.